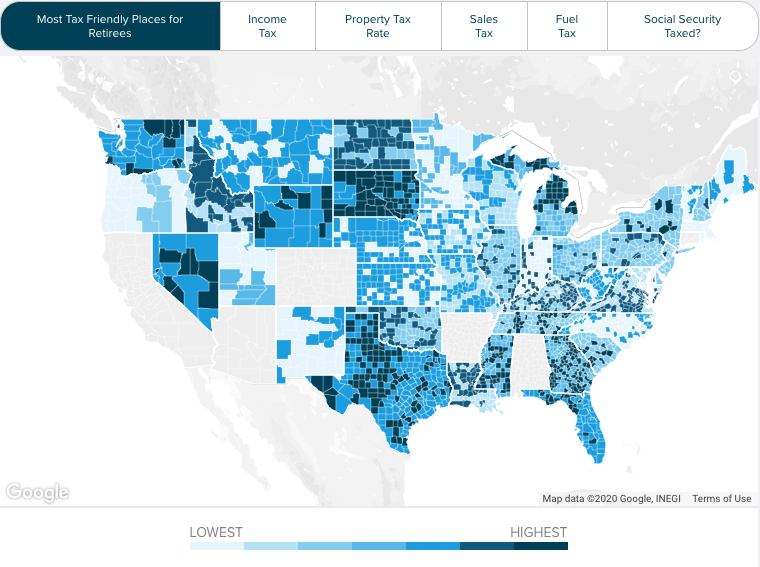

Colorado s sales tax is the lowest in the country out of states with a sales tax but county and city taxes mean coloradoans can end up paying more.

Colorado springs property tax calculator.

2020 coronavirus filing payment extension.

Overview of colorado taxes.

Most of that 47 76 mills goes to schools.

Counties in colorado collect an average of 0 6 of a property s assesed fair market value as property tax per year.

Due to several local laws that bar strong increases.

Overview of colorado taxes.

Colorado has seen some of the highest housing price growth in the nation over the last few years.

It is among the most populous counties in colorado.

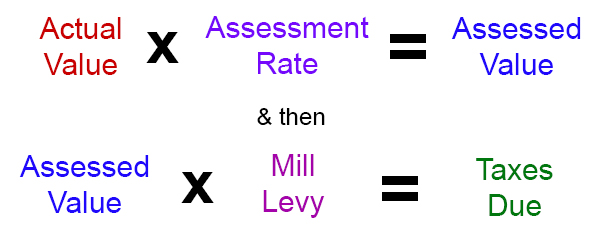

Our colorado property tax calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in colorado and across the entire united states.

The colorado springs s tax rate may change depending of the type of purchase.

8 25 is the.

The average effective property tax rate in el paso county is 0 49 less than half the national average of 1 08.

Start filing your tax return now.

The typical millage rate in el paso county is 0 54.

Colorado is home to rocky mountain national park upscale ski resorts and a flat income tax rate of 4 63.

Aside from state and federal taxes centennial state residents who live in aurora denver or greenwood village must also pay local taxes.

Colorado is ranked number thirty out of the fifty states in order of the average amount of property taxes collected.

To use the calculator just enter your property s current market value such as a current appraisal or a recent purchase price.

El paso county encompasses the city of colorado springs and surrounding areas.

Colorado has low property taxes and a flat income tax rate of 4 63.

The average effective property tax rate in colorado is 0 55.

Colorado springs city rate s 2 9 is the smallest possible tax rate 80940 colorado springs colorado 5 13 are all the other possible sales tax rates of colorado springs area.

There are 71 days left until taxes are due.